Readers less familiar with finance terminology may first find it helpful to consult the 'Overview of Terminology’ at the end of this Policy Paper.

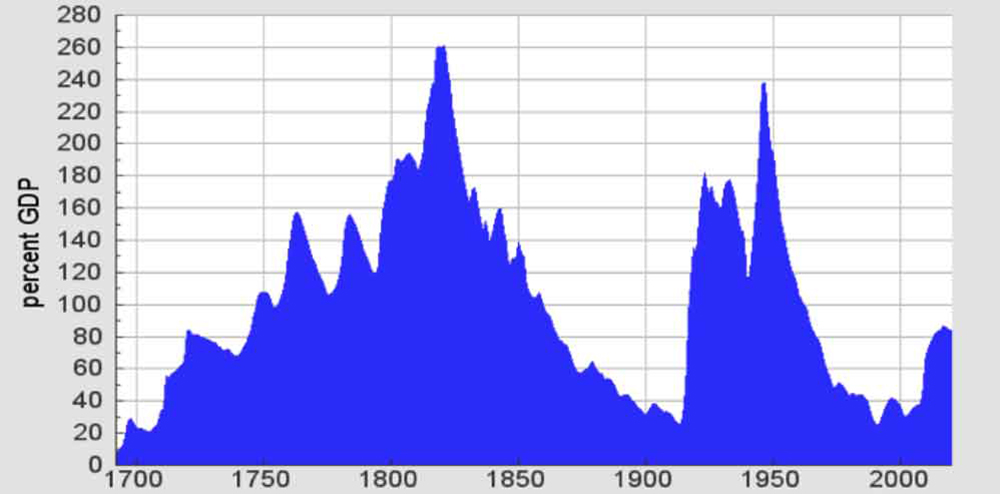

The Covid-19 epidemic is raising public debt levels across the globe. In Britain, the Office for Budget Responsibility estimates that the national debt will rise above 100 per cent of GDP for the first time since the early 1960s. As Figure 1 shows, the debt has been at or above this level for much of the last three centuries. Uniquely, the rise from just 39 per cent of GDP in 2008 has been driven by a global financial crisis and a global health crisis rather than war. The public debt first rose significantly during the long eighteenth century as the fiscal-military state engaged in increasingly expensive global conflicts. Despite various attempts to lower the interest cost with debt conversions, and the principal with sinking funds, it took a century of relative peace and economic growth to reduce the relative burden. The debt rose again during the World Wars of the twentieth century before the burden fell again through a combination of growth and inflation after 1945. During all this time, the nominal debt usually continued to rise. If the inflation target remains in place, therefore, significant future reductions in the debt burden must come from economic growth.

Figure 1. National debt as a percentage of GDP, 1694-2020.

Source: www.ukpublicspending.co.uk

The National Debt, ‘permanent by design, not simply through fecklessness’ (Slater), is a product of the 1690s, after the Glorious Revolution ushered in the checks and balances that placed the King ‘in parliament’. But this was only after the government, locked into an expensive struggle with Louis XIV, had implemented a land tax and a range of excise duties, and issued a raft of short-term debt, annuities and lotteries (see Overview of Terminology). The lasting innovation was the Bank of England, chartered in 1694 to raise revenue ‘toward the carrying on the War against France’. Private unlimited liability banks existed in England but they were small, with their operations restricted to the capital of their partners (limited to six individuals). Promoters had been lobbying for a larger, limited liability bank for some time. Against the backdrop of war they succeeded. In exchange for a monopoly on limited liability joint-stock banking, the Bank lent the government £1.2 million at 8 per cent in perpetuity. This provided the Bank with an income secured on earmarked taxes, and the government with permanent funding at less than the c. 14 per cent it had recently been forced to pay. The Bank was also bound to lend to the crown only with the express authorization of parliament and the sufficient allocation of taxes (‘funding’). As Slater points out ‘both parties had locked themselves into an indissoluble relationship’, with the public credit now backed by the credibility of the Bank and the authority of the King in parliament.

The National Debt stood at £14.5 million at the end of the Nine Years War in 1697. This equated to just under a quarter of GDP with the interest consuming about a third of government expenditure in 1698. The War of the Spanish Succession increased the debt to c. 55 per cent of GDP by 1714 through a combination of annuities, lotteries and company loans. In 1711, the Tory government, reluctant to bolster the power of the ‘Whig’ Bank, had chartered the South Sea Company. Alongside a monopoly on British trade with Spanish America, the South Sea Company was authorized to convert just over £9 million (face value) of short-term public debt into its own shares, immediately making it a considerably larger entity than the Bank. The Company then exchanged this debt for a perpetual 6 per cent government annuity. As a consequence, by 1714 nearly half of the national debt was held by the Bank, the East India Company (given its royal charter in 1600) and the South Sea Company. The rest was a combination of debt instruments, some but not all of which could be refinanced as interest rates fell from their wartime highs.

Interest rates did fall with peace in 1714. The government then set about lowering the interest payments that were consuming about half of public expenditure. Against the threat of forced repayment (and having to reinvest at even lower rates) the Bank and the South Sea Company ‘voluntarily’ reduced their annuities to 5 per cent in 1717. This opened the possibility of reducing the debt via a sinking fund. The mechanism worked as follows. Parliament had voted the taxes to service the debt at the higher wartime interest rates. At the lower postwar interest rates there would be an annual surplus that could be used to retire any debt trading below face value (‘par’). As debt was retired, so the aggregate servicing cost would further reduce, allowing more debt to be retired (and so on). For this to work over the long run, however, successive governments could not divert previously voted revenues to other purposes. Parliament cannot bind its successors but Walpole himself succumbed to temptation by repeatedly raiding his sinking fund during the 1720s. Nonetheless, he did reduce the servicing cost from more than half of government expenditure in 1721 to around a quarter in 1741 while stabilizing the debt at c. 70 per cent of GDP in 1741.

While the Bank and South Sea Company could be persuaded to lower the interest rate on their loans, there remained the problem of the ‘irredeemable’ annuities. Comprising about a quarter of the public debt in 1720, these illiquid instruments had often been issued under wartime duress and included 14 per cent lottery annuities, 9 per cent annuities to 1742 and 7 per cent annuities maturing as late as 1807. Investors were unlikely to convert these voluntarily into securities paying current rates at around 5 per cent, however much more liquid the new instruments may be. To retire these costly ‘irredeemables’ the authorities needed to supplement this future, lower interest income with the prospect of higher returns from elsewhere.

Britain and Spain had been at war when the South Sea Company was granted its monopoly on British trade with Spanish America in 1711. In July 1719 the company issued shares at 114 per cent of face value, suggesting its prospects had improved despite renewed hostilities with Spain. In April 1720 parliament authorized the South Sea Company to issue further shares, up to the aggregate face value of any public debt it could persuade investors to convert into those shares. The goal was to convert the entire national debt, save that already held by the chartered companies, into South Sea shares. After switching existing debt holders into its own shares, the Company would then exchange the debt received for redeemable 4 and 5 per cent government annuities, while paying the government a fee of up to £7.5 million. The higher the price of South Sea shares, the more debt the company could convert per share. With the share price at £200 and the face value of the government debt equal to £100, for example, the Company could convert the entire £31 million of subscribable debt into just £15.5 million nominal of new stock. But the Company was authorized to issue stock up to the total nominal face value of the debt converted. In this case, it could issue a further £15.5 million nominal of stock at £200 per share, securing itself nearly £8 million in profit after deducting the fee payable to the government. From the government’s perspective, the more debt converted, the higher the fee it would receive and the lower its subsequent interest costs. The lower its interest costs, the further it could reduce taxes. But the scheme rested on convincing investors that there was upside in the shares. The stage was set for one of the most notorious episodes in British financial history when the government encouraged a speculative bubble that saw fortunes made and lost in order to reduce the cost of servicing its debt.

In January 1720, South Sea shares were trading at 128 per cent of face value. In July they stood at 1000 per cent, fuelled by the company lending against the security of its own shares. By Christmas the price had fallen back to 155 but by then £26 million face value (c. 52 per cent) of the long-term national debt had been converted into South Sea shares with a face value of £8.5 million and South Sea bonds with a face value of £3 million. While the Spanish American trade did generate modest profits, for those who lost money speculating on the shares the South Sea Bubble was an embarrassment. From the government’s perspective it was a success, as the cost of servicing much of the national debt was reduced. Indeed, by 1733 the debt had been tamed sufficiently for Walpole to argue that creditors focused ‘not now which of them shall be paid first, but which of them shall be last paid’. When Henry Pelham converted higher interest debt to 3.5 per cent bonds in 1751 and then 3 per cent in 1757, none of the saving was devoted to retiring debt – it all went on lowering tax. Pelham’s conversion created two new securities: the 3 per cent Reduced and the 3 per cent Consolidated (‘Consols’), both managed by the Bank which extended its influence. By contrast, the South Sea Company became a passive investment vehicle that primarily passed on the interest it received from the government to its own stockholders before finally being wound up in 1853.

The South Sea episode combined with Walpole and Pelham’s reforms to create a national debt based on liquid, low interest perpetual bonds that could be redeemed via the sinking fund. While the national debt had been tamed, this machinery had also created the capacity to borrow ever more should the need arise. Indeed, by the time of Pelham’s second conversion, Britain was again at war with France. The Seven Years’ War raised the debt from £75 million (c. 100 per cent of GDP) in 1756 to £133 million (c. 157 per cent of GDP) in 1763. By the outbreak of the American War of Independence, a growing economy had reduced the relative burden to c. 106 per cent of GDP even if the nominal burden was only marginally reduced to £127 million. By the time peace was concluded with the Americans in 1783, the nominal debt had nearly doubled again.

The size of the debt now made it unlikely it would ever be fully repaid, a reality reinforced by Lord North’s policy of issuing discounted debt. North wanted to issue 5 per cent perpetuals but was beholden to the City financiers who underwrote the bond issues. In wartime financiers understandably preferred to underwrite liquid, discounted bonds that were less likely to be redeemed when interest rates eventually fell after the peace. This reflected Walpole’s observation that creditors were increasingly interested in being repaid later rather than earlier. Indeed, North argued that low coupon bonds were better for the taxpayer since ‘it was the interest that the people were burdened with paying of, and not the capital’. Should the government ever wish to repeat Pelham’s trick and convert the Consols to lower coupon securities, however, then the deeper the discount, the higher the cost of redeeming at face value.

A more immediate prospect was the purchase of discounted debt by a new sinking fund. The foremost exponent of the sinking fund, Reverend Price, decried the national debt for increasing the power of the state and the monied interest, for the ‘tribute’ paid to foreign debt holders, and the fact that the necessary taxes raised prices and burdened commerce. Price’s scheme differed from Walpole’s in that debt purchased at a discount would be held by the sinking fund and the interest income used to purchase increasingly more debt. The fund’s income would therefore compound faster than the annual contributions from earmarked taxes, ultimately allowing the entire debt to be extinguished (in theory, at least). Price convinced Pitt to set up a new Fund in 1786, this time with the ‘commitment mechanism’ of independent Commissioners for the Reduction of the National Debt. The Commissioners would devote £1 million of earmarked revenue to redeem debt trading at or above its face value (par), and buy and hold debt trading below its face value. When the fund’s income reached £4 million per annum, it would no longer buy and hold discounted bonds, but only redeem debt.

Within seven years of Pitt’s fund becoming operational, Britain was again at war with France. When the Revolutionary Wars began, the debt stood at £232 million (c. 117 per cent of GDP). After the Battle of Waterloo, it stood at £834 million (c. 250 per cent of GDP) with interest once again, as in 1714, consuming more than half of government spending. This was despite higher taxation, including the new income tax at rates of up to 10 per cent, covering more than half of government expenditure in the last decade of the war. Pitt had correctly anticipated a drawn-out conflict and rather than letting the floating debt accumulate as before, he executed four funding operations. Like North, Pitt would have preferred to issue less nominal debt at higher interest rates. Like his predecessor, he was forced by the City underwriters to issue discounted 3 per cents, further increasing the nominal amount of the debt and the cost of any eventual conversion or redemption.

The government continued its contributions to Pitt’s sinking fund during the war, despite having to borrow at higher interest rates to redeem lower yielding debt, adding an estimated £16.5 million (c. 2 percent of the 1815 total) to the national debt. Furthermore, the new debt was contracted in depreciated currency after the suspension of gold convertibility in 1797. It had to be serviced in stronger currency after convertibility was resumed in 1819, and without the revenues generated by the income tax, which had been repealed for the second time in 1816. The government could argue that the sinking fund had raised the price of 3 per cent Consols (by buying them), allowing more to be issued at the correspondingly lower yield. It could also argue that issuing 3 per cents was cheaper than issuing higher coupon bonds since the underwriters demanded a higher yield on Four or Five Per Cents, given the higher probability of post-war redemption. Nonetheless, sinking fund payments had kept taxation and borrowing at higher levels than would otherwise have been the case and Pitt’s sinking fund was dissolved in 1829. Walpole’s fund remained, although it relied for its income on ‘accidental’ surpluses created by departmental under-spending.

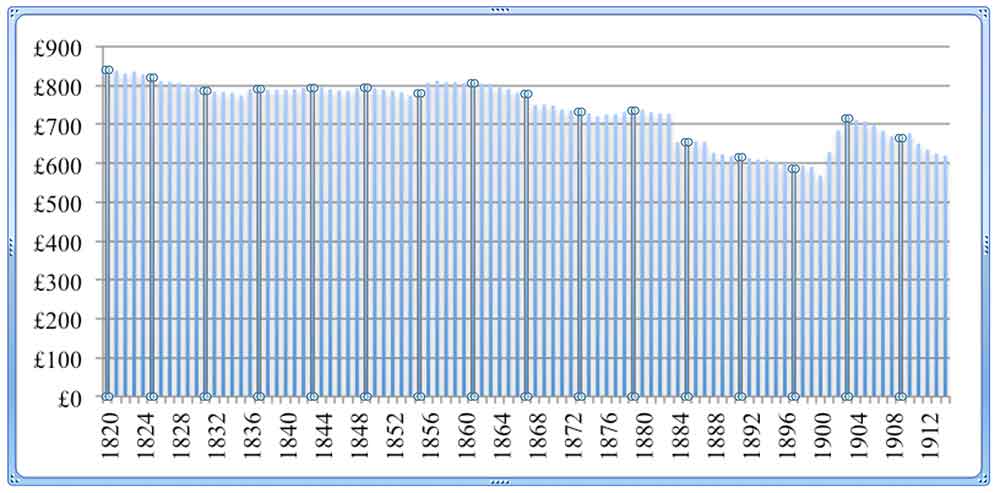

The national debt fell dramatically as a percentage of GDP from c. 250 per cent in 1820 to just 25 per cent in 1913. The nominal debt fell less dramatically, from £840 million to £625 million (Figure 2)

Figure 2. The national debt, 1820-1913 (£ millions)

Source: Bank of England.

The price level was slightly lower in 1913, so most of the reduction in the relative burden came from substantial, real economic growth. Figure 2 also shows that, despite nearly a century of peace (colonial, Crimean and Boer wars notwithstanding), significant reductions in the nominal debt came only after the 1850s.

Gladstone, Chancellor from 1852, was determined never ‘to go begging to the Bank’. This meant reducing the aggregate debt burden so the government would have greater borrowing capacity in the event of a future national emergency. But Gladstone also believed in low taxation. Rather than converting terminable annuities into perpetual debt as the South Sea Company had done, Gladstone converted perpetual debt into terminable annuities. This rested on the assumption that repayment of the capital component of the terminable annuity was a legal requirement (see Overview of Terminology). Parliament could therefore bind its successors by forcing them to fund the implied principal, as well as the interest, on public debt instruments. But Consols had become an attractive, liquid investment, with some trustees prohibited from receiving principal repayments. In the event, as with the seventeenth- and eighteenth-century operations, the principal converters were investors over which the government exercised some sway, in this case the Post Office Savings Bank and the Trustee Savings Banks.

Stafford Northcote, Chancellor from 1874 to 1880, had more success in reducing the nominal debt burden. His ‘New Sinking Fund’ legislated for annual payments of £27.2 million (rising to £28 million) to cover interest charges, with surpluses going towards redemption. This approach proved more sustainable because most of the £28 million went on the unavoidable servicing of terminable annuities rather than more avoidable purchases of existing debt. The growing economy also generated healthy tax revenues, reducing the pressure for revenues to be diverted, while the low interest environment permitted Goschen to reduce the rate on Consols from 3 per cent to 2.75 in 1889. After a further reduction to 2.5 per cent in 1903, with the debt standing at just 38 per cent of GDP, the servicing cost comprised around 15 per cent of government spending.

The British ‘business as usual’ war strategy in 1914 rested on bankrolling allies with larger armies to do most of the fighting while the Royal Navy blockaded the Germans into submission. The British government preferred to keep its labour force at home, producing munitions and the exports required to pay for imports of food and war matériel. The strategy changed in 1915 when Kitchener raised his conscript army. Britain had entered the war with the national debt at 27 per cent of GDP, consuming about 17 per cent of government revenue. But only about a quarter of the British war effort was paid for with taxation. By 1919 the debt had grown nearly ten-fold, and would continue to grow as a percentage of GDP after the British economy entered a deep depression in the spring of 1920.

In 1914 the national debt was composed almost entirely of 3 per cent Consols. By 1919, more than £2 billion of the £6.1 billion sterling debt was concentrated in one issue, the 1917 5 per cent War Loan repayable between 1929 and 1945. This issue was so large because the holders of the previous war loans could switch into it, exchanging their earlier loans at face value. With the market value of these earlier loans quickly falling below face value, most of them did. The 1917 War Loan was unlikely to be converted into lower cost debt while higher interest rates were required to rejoin and then stay on the gold standard at the pre-war parity of $4.86 (this happened in 1925 although the main impact of higher interest rates was felt in 1920-21). This was almost certainly overvalued since it assumed that relative prices would resume their pre-war level i.e. higher UK wartime inflation versus the United States would be reversed. It also took little account of reduced earnings on overseas capital. These had comprised c. 10 per cent of GDP in 1913. An overvalued pound required high Bank Rate to attract the overseas capital required to balance the external account. But after the War, New York exerted a larger gravitational pull on international capital flows. Only when the gold standard was abandoned in September 1931, and monetary policy independence was regained with the cheap money policy of 2 per cent interest rates from June 1932, could the conversion take place. Most of the stock was converted into 3.5 per cent perpetuals, redeemable after 1952.

There was also a new element to the national debt – borrowing in US dollars. In 1913 Britain had been the largest creditor with £4 billion of overseas capital representing 44 per cent of global overseas investment. Because of her superior credit standing, the Americans insisted on channeling lending through Britain. Indeed, Britain was a net dollar creditor in 1919, having lent more to France and Russia than she had borrowed from the Americans. But France would not pay until she received German reparations and the Soviet Union would not pay under any circumstances. After honouring her American debts in the 1920s, Britain resorted to token payments in 1932 before stopping all payments in 1934. The Americans responded with the Johnson Act, excluding sovereign defaulters from US capital markets. This caused difficulties at the start of WW2 when the British were forced to pay for supplies with existing reserves (‘cash and carry’) before Lend Lease was introduced in 1941.

WW2 was even more expensive than WW1, with the British contributing an estimated 84 per cent of GDP. Less than half was paid with borrowing. This was partly because the country entered the war with debt still around 140 per cent of GDP. By 1946 the debt stood at 240 per cent of GDP. Nonetheless, servicing the debt in 1946 consumed less than 10 per cent of government expenditure, about a third of the share in 1923 as the immediate imposition of capital controls and financial repression in 1939 enabled Britain to fight a ‘Three Per Cent War’. Approximately a third of the additional debt comprised short-term instruments such as Treasury bills. Just under a third comprised products designed for smaller savers such as National Savings and Post Office Savings, with the remainder (c. £6 billion) in longer-term debt.

Foreign assistance came mainly from American Lend Lease, but only after most of Britain’s remaining dollar assets had been sold to pay for supplies under cash and carry. Before the US entered the war Roosevelt was constrained in what he could offer. But from 1941 his government could ‘lease’ matériel to ‘the government of any country whose defense the President deems vital to the defense of the United States’. Even after Pearl Harbor, the Americans sought to avoid the debt entanglements that had caused such difficulties after WW1, providing Britain an estimated $31.4 billion of supplies before terminating Lend Lease in 1945. This was equivalent to about half the increase in the UK national debt during WW2. In 1946, denuded of overseas assets and with her export industries struggling to regain pre-war levels, Britain was forced to borrow $4.4 billion from the US. Unlike the American debt accrued during WW1 this 50-year loan at 2 per cent was finally paid off in 2006, albeit after several suspensions.

There was another international debt legacy of WW2 – the sterling balances. These were obligations to allies that had provided goods and services to Britain during the war, particularly countries like Egypt and India that had quartered and provided Empire troops. Unlike the USA, these countries could not afford to provide assistance at steep discounts. Instead, they accumulated over £3 billion of sterling balances at the Bank which they could, in theory, withdraw or exchange for dollars at any time. In practice, the Bank had insufficient reserves to pay, and the sterling balances loomed over British governments until the mid-1970s. The threat of withdrawals could force the government to reduce aggregate demand, contributing to the ‘stop go’ policies often blamed for postwar Britain’s relative economic underperformance.

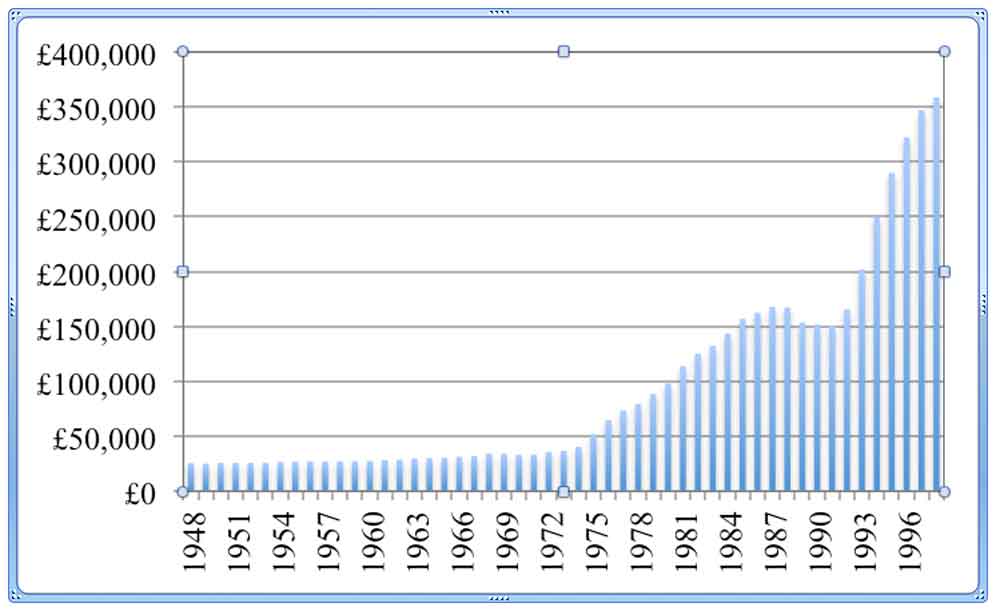

We have reached the part of Figure 1 where the national debt declined as a proportion of GDP even faster than during the nineteenth century. Once again, this was a period largely free of expensive wars. This time, however, the nominal debt increased as its ratio to GDP decreased.

Figure 3. The national debt, 1948-98 (£ millions)

Source: Bank of England.

In 1946 £24 billion of debt represented c. 250 per cent of GDP. By 2008, £557 billion of debt was equivalent to just 35 per cent of GDP. About 30 per cent of the percentage drop was attributable to real economic growth. The rest was attributable to inflation, with the price level more than thirty times higher in 2008 than in 1946. Unlike the Victorian purchaser of Consols who could expect their investment to hold its value, a buyer of the 1932 debt redeemed in 2015 had lost more than 98 per cent of their purchasing power.

The eighteenth-century British fiscal-military state borrowed sums that would have been unthinkable before the Glorious Revolution placed the King in Parliament and the financial revolution gave birth to the Bank of England. Walpole and his successors set up sinking funds, trusting to the arithmetic of compound interest. But they were also politicians who could not resist ‘laying hands’ on the revenues required for the sinking fund to work. In the nineteenth century, salvation lay instead in economic growth. As McCullough pointed out in 1845:

the stupendous inventions and discoveries of Watt, Arkwright, Crompton, Wedgwood and others have hitherto falsified all the predictions of those who anticipated national ruin and bankruptcy from the rapid increase of the public debt.

The compounding effect of economic growth, much more than the efforts of politicians, reduced the real debt burden from c. 250 per cent of national income in 1820 to around 25 per cent by 1914. Just as war raised the national debt in the long eighteenth century, so war raised it again during the first half of the twentieth century. Britain exited WW2 with a debt burden similar to that after Waterloo. It was again reduced to c. 30 per cent by 2002 through a combination of inflation and economic growth in the largely peaceful postwar period.

The Office for Budget Responsibility estimates that economic recovery will lower the debt from over 100 per cent of GDP to c. 95 per cent by the end of this financial year. This reinforces our conclusion that the most effective way to reduce the debt burden is through the arithmetic of compound economic growth. The coalition government’s austerity programme from 2010 was underpinned by Reinhart and Rogoff’s ‘finding’ that growth would be constrained with debt above 90 per cent of GDP. This turned out to be a spreadsheet error. While we should of course worry about rising debt levels, the British experience shows that is possible to grow out from under much higher debt levels. And with interest rates at historic lows, the longer the maturity of that debt, the better. Perhaps having retired the Consols in 2014, it is time to consider issuing perpetual debt again?

UK government bonds are debt instruments issued by HM Government, generally with a promise to pay periodic interest (‘coupons’) and to repay the principal (‘face value’ or ‘par’) on the maturity date.

Exchequer Bills were government bonds introduced in 1696 that paid interest and could be used to pay tax. Secondary liquidity was enhanced by government-appointed trustees who exchanged them for cash.

Treasury Bills are short-term government bonds (usually maturing within a year) that do not pay interest. They were introduced in 1877 and are (usually) issued at a discount to their face value.

Annuities are bonds that pay annual coupons that include an implicit repayment of principal since there is no principal repayment at maturity. They could be (finite) terminable annuities that lasted for one or more lifetimes or perpetual annuities that had no fixed maturity but which could usually be redeemed at face value by the government in exchange for cash. The government could not forcibly convert the terminable (or ‘irredeemable’) annuities but could induce holders to exchange them for e.g. South Sea Company shares if the terms were deemed sufficiently favourable.

A bond conversion involves the exchange of existing (usually ‘redeemable’) bonds for cash, a new asset (e.g. South Sea Company shares) or, more commonly, a new bond with different terms such as a lower interest rate.

The 1751 conversion ‘consolidated’ most of the national debt into perpetual annuities – (‘Consols’) and ‘Reduced Three Per Cents’. The last Consols were redeemed in 2014.

Government lotteries usually offered a fixed annuity to all ticket holders with additional bonuses for the ‘winners’. Lotteries could be attached to bond issues to encourage subscriptions and thereby lower the government’s average borrowing cost.

Tontines added lottery features to an annuity to reduce the overall cost to the government. Nominees (who could also be subscribers) were placed in groups with survivors receiving payments that increased as other group members died.

Underwriters guarantee the success of a bond issue by pledging to buy bonds that are not sold in the market at launch, usually at a lower price.

Sinking funds were repositories that purchased government debt, sometimes after a conversion had released tax revenue previously earmarked for paying interest at higher, pre-conversion interest rates. The debt could be redeemed or held to maturity with both approaches relying on compounding. In the first case, as the cost of servicing the debt declined with redemptions, increasingly more earmarked revenue could be diverted to redeem increasingly more debt. In the second case, the sinking fund’s increasing income could be used to buy increasingly more debt thereby further boosting the fund’s income to buy more debt. Both approaches relied on the government, and its successors not diverting earmarked revenue or raiding the fund.

J.H. Clapham, The Bank of England: a history 1694-1797, vol. 1 (Cambridge, 1944).

P.G.M. Dickson, The Financial Revolution in England (London, 1967).

E.L. Hargreaves, The National Debt (Abingdon, 2016).

M. Slater, The National Debt: a short history (London, 2018).

Download and read with you anywhere!

Sign up to receive announcements on events, the latest research and more!

We will never send spam and you can unsubscribe any time.

H&P is based at the Institute of Historical Research, Senate House, University of London.

We are the only project in the UK providing access to an international network of more than 500 historians with a broad range of expertise. H&P offers a range of resources for historians, policy makers and journalists.