Ireland and economic crisis

On 15 December 2013, Ireland became the first country in the periphery of the euro zone to emerge from its bailout that had been launched by the International Monetary Fund (IMF) in 2010. So painful was the collapse of the ‘Celtic Tiger’ economic boom, Ireland’s finance minister, Michael Noonan, said that the country had gone through the ‘biggest crisis since the famine’ of 1845-53. That judgement is undoubtedly right: the Irish famine does outweigh the more recent crisis in terms of the economic carnage, personal tragedy, and national humiliation it wrought, but both were catastrophic. Significantly, decision makers made similar macroeconomic policy choices before and during the famine and latest financial crisis, which exacerbated the economic situations and deepened the impact of the austerity measures that followed.

The global banking crisis of 2007 onwards hit Ireland hard. Peak to trough, Ireland’s GDP fell 14%. Economic growth since the country emerged from recession has been anaemic at best. For example, 22% of Irish mortgages by value are still in arrears, the highest anywhere in Europe. The human cost has also been dramatic. Unemployment jumped from 4% before the crisis to over 15% in 2012. Some estimates suggest that as many as a third of those aged 18-30 have emigrated since 2008.

That exodus was an uncomfortable reminder of the famine of 1845-53. The arrival of potato diseases such as phytophora infestans and dry rot from the Americas in 1845 destroyed Ireland’s potato crop and sparked a severe economic slump. Ireland’s GDP fell by 25% during the famine and about a million emigrated as the potato diseases destroyed the livelihoods of a third of the population. However, in the famine period, up to a further million died from starvation or related disease.

The economic and political legacy of the famine crisis is still significant today. The Irish economy took decades to recover in terms of GDP, and in 2014, Ireland (including Northern Ireland and the Republic combined) is the only place in Europe to have a lower population than in 1845. Mismanagement of famine relief increased resentment against British rule, leading the Irish Free State to split from the United Kingdom in 1922. The Republic’s enthusiastic embrace of euro membership since 2002 has also been seen as a rejection of its past as part of the United Kingdom, and its use of the pound sterling under the Act of Union.

However, the analysis in this policy paper shows that Ireland in recent times has fallen into a similar macroeconomic policy trap to that which frustrated the British government when it tried to bring relief to Ireland during the famine. This can be shown using a modern macroeconomic concept: the 'trilemma'.

The trilemma: choose only two policies from three

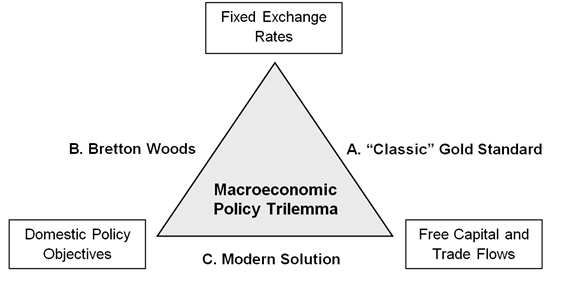

First identified by The Economist as the external ‘uneasy triangle’ in the 1950s, the macroeconomic-policy 'trilemma' was researched by two economists, Robert Mundell and Marcus Fleming over the next decade. They argued that it was only possible for governments to follow two of the three following policy objectives during periods of financial crisis: fixed-exchange rates, free movement of money and trade between countries, and an independent monetary and fiscal policy, which would include control of interest rates (Figure 1). If all three policies are followed, one will fail, probably in a disruptive manner.

Figure 1: Diagram of the ‘Trilemma’. In solutions A, B and C only the two adjacent economic policy objectives can be achieved at the same time

Explained in simple terms, if free capital flows and fixed exchange rates are maintained between a group of countries, and one tries to lower its interest rates below those of the others, unrestricted movement of money will take place from the country with low interest rates to those of high interest rates unless the rates are equalised. Under a gold standard, where money can be converted into gold bullion at the central bank, reserves will drain from the central bank with the lower interest rate until they run out of gold, the exchange rate falls, or interest rates are raised. This was an important mechanism in the crises of 1847 (position A in Figure 1). In the 2000s, Ireland belonged to the euro zone, which fixed its exchange rates with other members and had much the same effect as a gold standard, with the exception that it is far more difficult to leave.

Under a gold standard or fixed-exchange rate, a central bank’s reserves have to fulfil two functions. First, they support the currency against an ‘external drain’, or in other words, preventing a flow of gold or cash abroad through trade deficits or capital exports. Second, they back up the bank note issue in an event of an ‘internal drain’, or bank run (simultaneous demand for gold by holders of bank notes or bank-account deposits). Monetary policies, such as raised interest rates, and fiscal policies, such as deflationary budgets, that protect the central bank’s reserves against these two forms of drain therefore have to be adopted in the absence of restrictions on the export of capital.

Using data from 1870 to the present for 16 countries, Maurice Obstfeld, Jay Shambaugh and Alan Taylor have shown that this type of trade-off has influenced the outcome of macroeconomic policy over the last 130 years. When policy makers attempted to implement all three policies, one of them had to be abandoned. But the choice of maintaining an independent monetary policy is not always the option that is sacrificed, as it was during the Irish famine. In the 1931 panic during the Great Depression and the Exchange Rate Mechanism crisis of 1992, the UK decided to abandon the fixed-exchange rate instead of raising interest rates or imposing greater austerity (position C in Figure 1).

Financial crisis and the Irish Famine

The application of these ideas from international macroeconomics to Ireland's famine period is new, but their effect can be demonstrated by correlating details of what occurred with policy decisions. During the Irish famine it was decided the gold standard and free capital flows should remain and therefore interest rates rose uncontrollably, matching those of the United States. In 1847 there was a considerable trade in wheat between the UK and the US under Peel's low tariff policy, which speeded up the transfer of capital abroad. Due to both countries’ policies, most payments had to be made in gold rather than in bonds or international bills of exchange. This produced an unusually ‘perfect’, or restrictive, gold standard. As about half the UK's annual government budget was debt repayments, stringent control of public spending was necessary to avoid a fiscal deficit. A severe financial crisis, in which bullion was drained from the Bank of England in March and April 1847, correlates exactly with announcements that relief efforts were to be expanded. Policy makers reacted by cancelling government-funded relief efforts for Ireland in order to maintain the gold standard and threw the expense of relief efforts upon local Irish rate payers, who could not afford the entire burden. Politicians’ correspondence from the time confirms the link between fear of bullion drains and rising interest rates and cutting relief.

Robert Peel, the Conservative Prime Minister, and Charles Wood, the Chancellor of the Exchequer in the subsequent Whig government, although theoretically political opponents, both strongly supported maintaining two policy choices in the trilemma. Firstly, they were committed to the 1844 Bank Charter Act and Irish Banking Act of 1845, which linked bank notes to gold at a specific rate and produced a fixed-exchange rate with other countries using gold. Secondly, their low tariff policies, the scaling back of the Corn Laws in 1842 and 1846, and the refusal to impose capital controls during the crises of 1847, produced, in effect, free capital flows as money had to follow the freely traded goods. Both men also pursued a balanced budget which required low interest rates. They intended these policies to provoke a short-term fall in the prices of food and other commodities to help the poor and avoid the kind of revolutions which occurred on the continent in 1848.

Although these policies, in retrospect, appeared to boost economic growth in the early 1840s, the structural shock caused by the Irish famine to the British economy created internal and external drains on the central bank’s reserves, and, as a result, financial crisis. The internal drain was initially prompted by the fiscal shock of famine relief on the public finances. On 1 March 1847, a bill authorising the British government to borrow £8 million (equivalent to over 2% of GDP) to fund its continuing famine relief efforts in Ireland was read in Parliament.

The announcement of the legislation immediately triggered a panic in the London financial markets. Government bond yields (an indication of the cost of government borrowing) rose to levels not seen since the 1830s and there was a run on sterling banknotes at the Bank of England, draining liquidity out of the money markets and threatening the Bank’s ability to honour Peel and Wood’s gold standard. Over £5 million in gold leaked from the Bank of England in just a month, as investors rushed to redeem their bank notes. As The Economist noted at the time, this was due to the fear in London’s financial markets that the Irish loan would make their bank notes unconvertible to gold. By the start of April the size of the loan was roughly equal to the gold reserves of the Bank of England, and it was feared that the government would spend all the £8 million on foreign corn in bullion within a matter of months, leaving the Bank of England no bullion in reserve to redeem banknotes in gold later in the year.

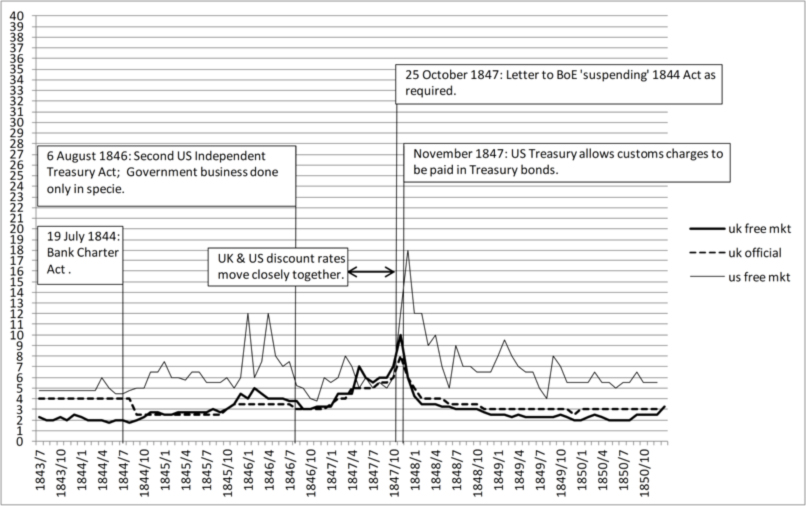

The effect of the trilemma can also be seen in the context of a longer-term external drain due to the corn trade with America and is clearly visible when comparing UK and US interest rates. During the first three quarters of 1847 the dollar-pound exchange rate remained stable. Trade was effectively restricted to payment with gold bullion rather than bills of exchange by the 1844 Banking Act in the UK and Independent Treasury Act in the US by which payments to government (such as taxes and tariffs) had to be made in gold or silver in order to finance a war with Mexico. As a result, American banks and merchants throughout the early famine period insisted on being paid in gold bullion. The lack of restrictions on capital movement, the high trade volumes in grains after the famine started, and the lowered corn tariffs in 1846, ensured arbitrage, which takes advantage of price differences, would take place which, according to the trilemma model, should have equalised interest rates.

Figure 2: UK and US monthly discount rates (%) against time

Figure 2 shows that UK interest rates closely matched US rates between April and October 1847― confirmation that the trilemma lay behind the crises of 1847. Afterwards, UK rates fell off slightly at the time Russell and Wood gave the Bank of England indemnity against unlimited issue of bonds, on 24 October 1847, so that exports of bullion were not necessary to meet foreign payments. Similar relaxations to the gold standard in the US allowed interest rates in the two countries to settle about 2 percentage points apart.

But in order to restore financial confidence in full after the internal and external drains, the British government was forced to U-turn on its plans to borrow to fund famine relief in Ireland. Originally, the loan bill stated that only half of the expense was to be recouped from Irish property via the Poor Law, the local welfare system in Ireland. But on 16 April 1847 the government announced it would place the entire loan on the security of Irish Poor Law rate payers and would only issue loans to Poor Law Unions, which managed the relief efforts at a local level, at a much slower pace. The aim was to reduce the drain on the Bank of England’s remaining gold reserves. The resulting Irish Poor Law Extension Act of June 1847 placed total responsibility for repayment of the £8m on Irish taxpayers, in order to remove the costs of Irish relief from the Treasury’s balance sheet. In words of Richard Bellew, an Irish Catholic Lord of the Treasury, the legislation made ‘the property of Ireland responsible for the poverty of Ireland’.

This series of events was devastating for Ireland. The sharp reduction in overall government expenditure during the 1847 crisis, visible in British national accounts, hit Irish relief spending heavily as the largest category of discretionary spending (amounting to a quarter of ordinary public expenditure in 1846). Advances to Poor Law Unions amounted to £4,080,000 in 1846-47 and £2,139,000 in 1847-48, but ended completely by March 1848. Treasury grants from central government funds for Irish relief fell by 60% between 1847-48 and 1848-49. After 1849, central government assistance for Irish relief dwindled further, with only £113,543 allocated towards grants to those emigrating and virtually nothing for food or employment for the poor who remained in Ireland. The cuts must have contributed to the surge in deaths from malnutrition after 1847, which peaked between 1848 and 1850, when central government support had been drastically reduced. In short, the gold standard, not the potato blight, was responsible for the deaths of so many Irish people after 1847.

The economic crisis surrounding the Irish loan was hushed up at the time to try and quell the financial panic which it was believed, if unrestrained, might bankrupt the British Empire. Ever since, nationalist suspicions that British politicians had a secret plot to starve the Irish people has poisoned relations between the two countries.

Yet the cause of the financial crisis was the government's misunderstanding of how economic policy functioned. Its inability to raise further finance for relief from the London financial markets in 1847 meant the UK was prevented from following an independent monetary and fiscal policy in order to relieve the Irish famine. Its policies had become the three incompatible policies of the trilemma, and the loss of control over interest rates is consistent with modern theory. Of course, neither Peel, and still less Wood, fully understood what was happening. The 1844 Bank Charter Act was suspended only very briefly, because it was considered essential to maintaining overall financial stability. Wood himself said at the time:

I confess I am puzzled by the whole story ― and I suggest there is a mare’s nest at the bottom of it.

Financial crisis and the bailout of 2010

Economic policy in the run-up to the 2008-14 crisis, like that before the famine, reflected the trilemma policies. Ireland joined the euro zone in 2002 and as a result was in a currency union with a fixed exchange rate and free capital flows with other member countries. The European Central Bank (ECB) took over monetary policy and set interest rates for all countries of the euro zone with the aim of overall stability, but not specifically for the domestic advantage of Ireland. As a result, Ireland had a property and banking boom driven by low interest rates.

The economic shock which hit was not potato disease, but the global business cycle peaking around 2007 and the subsequent severe international banking crisis and global recession in 2008. This caused Ireland's property sector, mortgaged to the hilt, to slide in value. Then the collapse in confidence of the American bank Lehman Brothers, in September 2008, threatened the ability of Ireland's major banks to refinance themselves. As a result, the Irish government passed legislation to put an unlimited state guarantee behind €400 billion of potential liabilities of Ireland's six largest banks. The Irish government did not know the scale of the banks’ unsafe loans, and the Irish state and ECB was forced to bail them out with an actual €150 billion of liquidity to fulfil their rash guarantee. This swelled the Irish government's debt to over 100% of GDP which led to capital flowing out of Ireland. Interest rates on government debt surged to over 7% as the markets doubted that Ireland could service such debt, or even remain in the euro zone.

So Ireland had 'fed' its banks, starved of credit, just as the UK had tried to feed the Irish people during the famine on credit. But in doing so, Ireland pushed itself almost to the point of default, just as the British government was afraid the Bank of England might go bankrupt in 1847. As Ireland was in a fixed-exchange rate system with other gold standard countries with free capital flows, it could not pursue its own monetary policy to reduce interest rates to help prevent the banks or the real economy from collapsing. Nor could it pursue its own fiscal policy to bailout its banks or provide the economy with a deficit-financed stimulus. Irish politicians were unwilling to leave the euro zone and adopt a devalued currency for Ireland and instead accepted an international bailout in 2010 that stipulated Ireland should reduce its budget deficit to under 3% of GDP by 2015. As a result, taxes increased, public spending fell by a third, unemployment surged to over 15% and real incomes fell by 20% in Ireland. Emigration abroad and a lost generation of unemployed at home were the consequences of the macroeconomic policy choices made by Irish politicians. The national pride that the Celtic Tiger boom puffed up spectacularly burst.

The perils of fixed exchange rates

As this policy paper has shown, Ireland has suffered twice from the choices made by policy makers to try and follow all three of the trilemma policies. The lesson to be learnt is that policy makers should prioritise the internal stability of an economy (of prices and employment) before abstract principles aimed at maintaining external financial stability (of exchange rates or the free movement of capital, for instance), and be more sensitive towards possible problems when deciding to join currency unions.

However, Ireland leaving the euro zone is not an attractive option for Irish or European policy makers at the moment. As The Economist recently pointed out, a potential ‘Grexit’ of Greece from the euro area would be bad for Greece, and the remaining member countries. A theoretical ‘Irexit’ would similarly spread financial contagion through Europe because the value of Irish assets in other countries would tumble if the recreated Irish currency fell in value. In 2010 alone, British and German banks possessed $271 billion of Irish assets, more than enough to prompt a banking crisis in both countries if they suddenly declined in value. In turn, such an event would create more problems by reducing demand for Irish exports from these places.

However, politicians in other countries can learn from the historical mistakes made by Irish policy makers. Members of the EU in Northern and Eastern Europe are bound by treaty law to eventually join the euro. In West Africa, there are plans to create a new currency, the eco, covering 14 countries and 300 million people. But recent research by the IMF suggests that many of these countries are far from ready in terms of their economic indicators moving together with those of other members of the current or proposed currency blocs. Ireland’s disastrous experience as a member of currency unions with inappropriate policies in the 1840s and 2000s should serve as a historical note of caution. Unity, even in currencies, may be a matter of good faith, but faith need not be blind.

R. Mundell, ‘Monetary Dynamics of International Adjustment Under Fixed and Flexible Exchange Rates’, Quarterly Journal of Economics 74 (1960).

M. Obstfeld, J. Shambaugh and A. Taylor, ‘The Trilemma in History: Tradeoffs among Exchange Rates, Monetary Policies, and Capital Mobility’, NBER Working Paper 10396 (2004).

Download and read with you anywhere!

Sign up to receive announcements on events, the latest research and more!

We will never send spam and you can unsubscribe any time.

H&P is based at the Institute of Historical Research, Senate House, University of London.

We are the only project in the UK providing access to an international network of more than 500 historians with a broad range of expertise. H&P offers a range of resources for historians, policy makers and journalists.