The ideal banking system is one that is both stable and competitive. If that is achieved financial crises are avoided, savers receive satisfactory rates of interest, and borrowers obtain the funds they require on the terms and conditions they want. Such an ideal is probably unobtainable and no degree of intervention by governments can make it happen. Successful banking involves a constant compromise between the opposing needs of savers and borrowers. Savers want low risk products that can be instantly converted into cash but yield a high rate of return. Borrowers want banks to lend them money for long periods at low rates of interest and accept a high degree of risk that a default may occur. A balance must always be struck between the two, while also generating sufficient income for banks to cover their costs, and make a profit. These principles apply to all banks at all times in all countries but can be achieved in many different ways. At no time in any country has the perfect solution been found. Even if it was temporarily achieved it would be unlikely to last long since banking must continuously evolve to meet the changing needs of society and economy.

The greater complexity of modern life puts greater and greater demands on the banking system to provide payment systems, savings products and credit facilities. An integrated global economy dominated by multinational corporations creates very different requirements for banks compared to a world in which business was conducted by a vast number of individual enterprises on a more local basis. Banks have been widely blamed for precipitating the GFC because of their reckless lending and financial innovation driven by the bonus culture that prevailed at the time. As the epicentre of that crisis was the USA it is experience there that has commanded worldwide attention. It is solutions proposed by the US government that attract global interest and possible emulation. For that there exists the precedent of what took place in the USA in the early 1930s in the wake of the Wall Street Crash. In the aftermath of that financial crisis the US government intervened both to stop the daily collapse of individual banks and to restructure the banking system so as to reduce the risks being run. That was then followed by a long period of banking stability in the USA. But does that US precedent provide a valid guide to what should be done in the UK today?

In 1921 the number of banks in the USA peaked at over 30,000 before beginning a steady decline during the rest of the decade. The existence of so many individual banks was the product of rapid US economic growth over the previous century combined with legislation introduced in the 1860s that greatly restricted or even prohibited branch banking. The passage of such laws reflected deep rooted tensions between Federal and State authorities within the USA which continue to this day. The legal restrictions on branch banking made it impossible for US banks to achieve the scale and diversity that would make them resistant to localised crises. As a result there was a constant mortality of individual banks within the US banking system. That mortality reached epidemic proportions in the early 1930s in the wake of the Wall Street Crash of 1929. In the crisis year of 1933 a total of 4,000 US banks were forced to suspend operations, or 21 per cent of the total. This high degree of failure proved to be a tipping point as it forced the US government to intervene in order to prevent further collapses as savers rushed to withdraw their deposits from those banks still operating. The means used to re-assure savers was the introduction of state guaranteed deposit insurance based on the contribution by all participating banks to a rescue fund managed by the Federal Deposit Insurance Corporation. By guaranteeing that deposits would be safe there was no reason for savers to remove their money from a bank rumoured to be in difficulty, which had been having the effect of destabilising even solvent institutions as they lacked sufficient liquid funds to meet excessive withdrawals. Deposit insurance did raise the issue of moral hazard as it guaranteed the deposits of all participating banks whatever risks they ran, so encouraging both bankers and savers to disregard security in favour of the highest rate of return. To ward against that there was a cap on the interest rate paid by banks so removing the incentive to compete for savings. Added to the existing prohibition on branch banking the result of these measures was to restrict competition in the US banking system.

The Wall Street Crash of 1929 was blamed by many on the selling by banks of corporate stock to their customers during the 1920s. This was believed to have encouraged a speculative bubble as investors pushed stock prices higher in the pursuit of large gains, and used borrowed funds for their purchases. When the inevitable reversal took place, as some investors sold out and took their gains, many investors suffered large losses and could not repay their loans, leaving banks and other lenders at best illiquid and, at worst, insolvent. Whether the few banks that combined deposit and investment operations were responsible for the Wall Street Crash has been much disputed subsequently but was widely believed at the time. This led to the Glass-Steagall Act in 1933 which banned the combination of deposit and investment banking. Also introduced in the 1930s was the Securities and Exchange Commission which was given the responsibility of regulating the stock exchanges, as some of their practices, such as short-selling, were also believed to have contributed to the Wall Street Crash.

Under these circumstances most US banks remained local and lacked the scale to serve ever-larger business customers while savers increasingly looked for alternatives in order to obtain higher rates of return. This created opportunities for the investment banks as they could operate nationwide and grow to meet the needs of business customers. It also drove a few of the largest US banks to establish operations abroad as that would allow them to escape the restrictions imposed by their own government and so become better able to meet the needs of their potential business customers as they expanded internationally.

With the deregulation of Wall Street in 1975, driven by the Securities and Exchange Commission, American investment banks were able to expand aggressively. The rules imposed by the New York Stock Exchange on its members had restricted competition, and their removal allowed the largest and most efficient investment banks to grow in size and scale. The result was a US banking system of considerable diversity ranging from tiny local banks through large New York deposit banks to specialist investment banks. Such diversity was a creation of government policy, but - in preventing the evolution of banking activities - was increasingly at odds with the needs of both savers and borrowers living in a highly integrated economy, where growth of business required banks to operate at a larger scale and offer more sophisticated financial products to clients of all types. During the 1980s and 1990s many of the legislative restrictions placed on US banks were removed. Control over interest rates was ended while the prohibition on branch banking was increasingly relaxed. The result was a great increase in competition not from the entry of new banks but the expansion of existing ones as they offered attractive terms to both savers and borrowers. Finally, the Glass-Steagall Act was repealed in 1999 allowing banks to combine deposit taking and investment banking, so enabling the creation of US banks that spanned all financial activities.

It was this banking system that proved so vulnerable in the face of the 2007-08 global financial crisis. In the rush to expand over the previous 30 years US banks had taken more and more risks, confident that the business models they had adopted would prove successful. On the one hand there were banks building up a large branch network and aggressively competing by offering attractive terms to savers and borrowers. On the other hand, there were the investment banks designing new financial products that appealed simultaneously to investors and borrowers. All this was encouraged by successive US governments keen to promote home-ownership by making access to mortgages easier and borrowing extensively because they were unwilling to restrict economic growth by reining in deficit spending. During the financial crisis, a number of the newly created financial conglomerates, both over-expanding retail banks and risk-taking investment banks, either failed, were acquired by other banks or rescued by the government. The wisdom of the quite thorough degree of de-regulation of banks that occurred over the preceding thirty years has now been questioned. However it is the fundamentals of US banking that should be scrutinised. These fundamentals are: the acceptance that retail banking is best conducted as a nationwide activity through a branch banking system; that New York is the global centre for investment banking; and that a central bank operates best when it is a single institution located in a major financial centre and allowed to operate free from government influence.

In Britain the banking system largely evolved without active government intervention. The Bank of England had been founded in 1694 as a private institution and developed a role for itself as lender of last resort to the banking system over the course of the nineteenth century. In general, it provided financial support for failing banks only when those banks were deemed to be suffering from liquidity, not solvency problems. Thus there was no general belief that a bank would be saved, and a number were allowed to collapse following panic withdrawals and these did result in losses for depositors. For instance, the Birkbeck Bank collapsed shortly before the First World War and Farrow's Bank shortly afterwards. By the late nineteenth century Britain possessed a central bank that was experienced in supporting the stability of the banking system, and operated selectively, so avoiding moral hazard.

Over the course of the nineteenth century the British banking system was also transformed. In the first half of the century England was a country populated by numerous small banks. Until 1825 when joint-stock banking was permitted for the first time, apart from the Bank of England itself, other English banks had been restricted to small partnerships. Either through fraud or mismanagement many banks failed, while every local or national crisis led to a spate of collapses. These banks, unlike the Bank of England, lacked the capacity to withstand any adverse circumstances. Scotland, where the legislation did not apply, had created a much more stable banking system by the beginning of the nineteenth century, populated by a small number of large banks. The counter-point of being too big to fail is being too small to survive.

Once English banks were permitted to organise themselves as companies they became increasingly stable. The greatly increased scale of operation allowed banks to recruit, train and monitor their staff so that they became better aware of the risks involved in financing long-term loans with short-term deposits. Banks could also raise large amounts of capital as they had access to the resources of the investing public and this provided a much more secure basis for their operations than the funds possessed by a few partners. The development of a branch system managed from a central head office also allowed banks to spread themselves geographically and by business activity, so reducing the risks they ran. Finally, the existence of an active inter-bank money market allowed banks to maximise the resources they had available as surplus funds could be easily lent out overnight and temporary scarcity met. The result was the emergence of a small group of banks that both competed with each other in attracting deposits and making loans and co-operated in re-distributing temporary funds. By the First World War the British banking system had become the envy of the world, able to withstand the financial crises that afflicted many other countries. That did not mean that none of these larger banks failed for some did, such as the City of Glasgow Bank in 1878, but the system as a whole was able to cope with that. Individual bank failure can never be eliminated in a competitive banking system.

The British banking system then withstood the effects of two world wars and the global financial crisis of 1929-1932. The one British bank that experienced serious difficulties at that time was Williams and Deacons, as it focussed on lending to the depressed Lancashire cotton textile industry. It was absorbed by the Royal Bank of Scotland at the invitation of the Bank of England. This reputation for stability then continued after the Second World War. Even the secondary banking crisis of 1974 left the large British banks unscathed and thus able to participate in a rescue organised by the Bank of England. British banking appeared to have discovered a workable balance between competition and stability that had escaped other banking systems. Stability was now taken for granted and British banks were criticised for their conservative lending policies, an attack begun by Keynes at the outbreak of the First World War and continued thereafter. Less criticised was the low rate of interest paid by the largest banks on their deposits for these did encourage some savers to search for alternatives, as with the flow of funds into building societies to be re-lent on mortgages.

In response to these criticisms government policy moved towards encouraging greater competition in banking. This had its first flourish in the early 1970s but then petered out in the crisis of 1974. It then returned in the wake of the de-regulation of the Stock Exchange with Big Bang in 1986. This transformation of the London Stock Exchange from a conservatively run club into an open global market was a model it was assumed could be followed elsewhere in the financial sector. In banking this took two forms. One was the de-mutualisation of a number of building societies and their conversion into banks. A similar fate was experienced by the Trustee Savings Bank which was converted into a company and sold to investors. This greatly intensified the competition for both savings and loans.

The second form was the behaviour of the two largest Scottish banks. These had long enjoyed a monopoly in Scotland because of the political reluctance of the UK government to accept their absorption by English banks. That position ended when the Royal Bank of Scotland was permitted to acquire the National Westminster Bank in 2000. Once acquired by RBS, NatWest became an aggressive competitor in British banking, forcing others to respond. The Bank of Scotland then attempted to emulate its rival's advance into England through a merger with the de-mutualised Halifax Building Society, hoping to become the fifth force in British banking. In the wake of these changes British banking became intensely competitive to the benefit of both savers and borrowers, though few recognised the dangers inherent in the ensuing credit bubble. What had conspicuously not happened, however, was the creation of any large British banks combining retail and investment banking in the wake of the de-regulation of the London Stock Exchange. A few deposit banks had experimented with such a move, such as Barclays, but then abandoned it. Instead, the London investment banking scene was dominated by banks from the USA and Continental Europe, which had also acquired the previous, leading UK investment banks. Morgan Grenfell was bought by Deutsche Bank, Warburg's by UBS and Kleinwort Benson by Dresdner Bank, for example, while Lehman Brothers and Merrill Lynch became the largest traders on the London Stock Exchange. This left the remaining British-owned investment banks, such as Rothschilds and Schroders as relatively minor players operating in niche areas.

Financial services generally, and the City in particular, became a rapid growth sector, generating both employment and tax revenues and compensating, in balance of payments terms, for the shrunken state of British manufacturing. Light touch regulation was seen as the key to success and so the oversight of the banking system was removed from the Bank of England. Instead, all financial services were made the responsibility of a tripartite structure in which authority was shared between the Bank of England, the Financial Services Authority and the Treasury. One consequence of this light touch was to take the stability of British banks for granted and so ignore the growing volume of off-balance sheet operations being undertaken, especially by the demutualised building societies. Another was the permission given to RBS to greatly over-extend itself through the purchase of ABN/AMRO at a time when the fragility of the global banking system was already apparent. The prudential banking regulation of the past had been replaced by a growth strategy, infamously based on the former Chancellor Gordon Brown's belief that boom and bust had been banished forever. As a consequence bankers believed there was less need to hold large but low-yielding capital reserves and instead employed their funds in more remunerative lending. Such a policy generated rising profits out of which bonuses, dividends and taxes could be paid. But it also made the system vulnerable to wider shocks and as such contributed to the British experience of the global financial crisis.

Since 2007, the British banking system has been reverting to the model that served it well in the past. Oversight of banks lies, once again, with a Bank of England now conscious that stability cannot be taken for granted. The de-mutualised building societies have all disappeared. The Spanish Bank, Santander, absorbed the Abbey National, Alliance and Leicester and the retail activities of Bradford and Bingley, while Northern Rock has been acquired by Virgin Money. HBOS was taken over by Lloyds in a disastrous move prompted by the government in a failed attempt to prop it up without state intervention. The result leaves Britain with a few very large banks. Each of these is different. Santander is a subsidiary of a Spanish Bank managed from an office complex just outside Madrid. It is building up a large UK retail operation. Lloyds/HBOS is a very large UK retail bank, and is being forced to sell branches so as to reduce market dominance. The government owns 40 per cent of it following its rescue. Barclays has converted itself into a universal bank, combining commercial and investment banking, through the purchase of the Wall Street business of Lehman Brothers after its failure. HSBC is a global bank with a largely Asian focus and is run jointly from London and Hong Kong. Standard Chartered is a London-based bank whose business is entirely in emerging economies. Finally RBS, which is 80% government owned after its rescue, is being re-structured through disposals so that it can become a more stable and manageable bank. Since 2007 each of these banks has adopted a strategy to meet the challenges and exploit the opportunities present in a rapidly changing world. For some a strong focus on UK retail banking is seen as the model to follow, while others have taken the route of global expansion. With hindsight it is clear that, in the 10 years before 2007, a number of British banks had adopted business models that could only be successful in an environment of continuous economic growth and credit expansion. Such an environment could not be sustained indefinitely and when it ended these business models were exposed as deeply flawed.

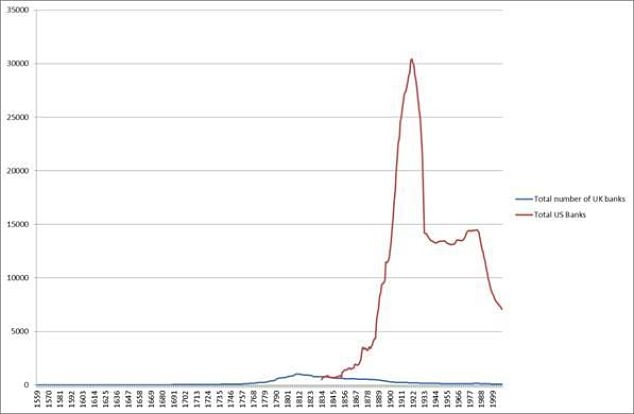

Chart 1: Total Number of UK and US banks, 1559-2008

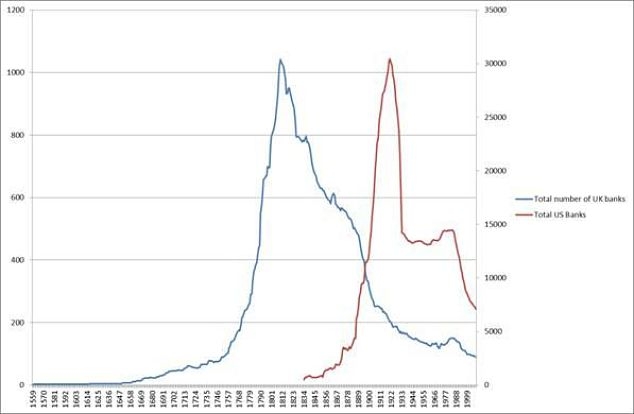

Note the pattern before the peak in each case, but the different trajectory afterwards.

Chart 2: Total Number of UK and US banks, 1559-2008, based on different scales (UK left and US right vertical axes)

The data used to produce these charts was assembled from the following sources:

In order to reduce the risks associated with banking in a globalised world what is really needed is a global lender of last resort for the banking system. For now, though, ongoing cooperation among central banks is the best option for ensuring that the international payments system does not break down with devastating consequences for the global economy. In light of this, the return of the Bank of England to its historical role as both lender of last resort and regulatory supervisor of the UK banking sector is welcome. Also welcome is the requirement that UK banks hold more capital as this returns the UK banking system to more historically typical capital requirements. Britain also faces the question of the moral hazard associated with the government's rescue of the failed banks in 2007-08 and the implicit guarantee given to the entire banking system. As long as bankers believe that the government will support them in any crisis, the restraints that ensure prudential banking behaviour are reduced or even removed. Similarly, as long as those who deposit money in a bank believe that it will be secured by the government, at no cost to themselves, they will chase the best rates of return irrespective of the risks run. How then to protect retail depositors while reducing moral hazard?

The Independent Commission on Banking (the Vickers Committee) has proposed a ring fencing of retail and investment banking. This aims to safeguard retail deposits by preventing their use in the more risky areas of a bank's activities. Such a statutory requirement has no historical precedent in the UK banking system, unlike that of the US. While it could be a perfectly appropriate response again today for the USA to adopt this approach, given the structure of its banking system, which still has several thousand independent small retail banks, it is not necessarily the case that it would be the best option for the UK today. Indeed, it could force a major restructuring of some UK banks, which may not have beneficial consequences for anybody. Therefore another option worthy of consideration by policymakers would be a refinement of existing arrangements for deposit insurance, whereby banks would have to pay premiums according to the risks they run. Over the centuries the UK insurance industry has allowed risks to be insured on commercial terms. Contracts have been designed to meet most eventualities, with the premium charged being priced according to the risks involved. In marine insurance not only can the ship and its cargo be insured but also any damage that it may do whether through collisions or oil spills. Mandatory market based insurance has proved effective in reducing risky behaviour with the cost borne not by the tax payer but by those who pay the premiums. Now appears an opportune time to consider devising similar insurance for bank deposits that would extricate the UK government from the moral hazard dilemma it has created for itself through the rescue of banks and bank depositors. In turn, the availability of deposit insurance which gauged risk would allow banks to safeguard retail depositors while evolving and adapting to the challenges and opportunities present in a rapidly changing global economy.

P. Augar, The Death of Gentlemanly Capitalism: The Rise and Fall of London's Investment Banks (London, 2001)

Youssef Cassis, Capitals of Capital: A History of International Financial Centres, 1780-2005 (Cambridge: Cambridge University Press, 2006)

Youssef Cassis, Crises and Opportunities: The Shaping of Modern Finance (Oxford University Press, Oxford 2011)

Richard S. Grossman, Unsettled Account: The Evolution of Banking in the Industrialized World since 1800 (Princeton University Press, Princeton 2010)

John Raymond LaBrosse, 'Time to fix the plumbing: Improving the UK framework following the collapse of Northern Rock', Journal of Banking Regulation, 9 (2008), pp. 293-301

R.C.Michie, The Global Securities Market: a History (Oxford University Press, Oxford 2006)

R.C.Michie, 'The Emergence and Survival of a Financial Cluster in Britain' in Learning from some of Britain's Successful Sectors: An historical analysis of the role of government (BIS Economics Paper No.6, Department of Business Innovation and Skills, 2010)

Alan D. Morrison and William J. Wilhelm Jr. Investment Banking: Institutions, Politics, and Law, (Oxford University Press, New York 2007)

C.M. Reinhart and K. S. Rogoff, This Time is Different: Eight Centuries of Financial Folly (Princeton University Press, Princeton, 2009)

R.S. Sayers, The Bank of England (Cambridge University Press, Cambridge, 1976)

John Singleton, Central Banking in the Twentieth Century (Cambridge University Press, Cambridge, 2011)

Independent Commission on Banking, Final Report Recommendations (September, 2011), available on the Commission website.

Sign up to receive announcements on events, the latest research and more!

We will never send spam and you can unsubscribe any time.

H&P is based at the Institute of Historical Research, Senate House, University of London.

We are the only project in the UK providing access to an international network of more than 500 historians with a broad range of expertise. H&P offers a range of resources for historians, policy makers and journalists.